|

390 East 49th Street, Brooklyn (East Flatbush), NY, 11203 | $1,120,000

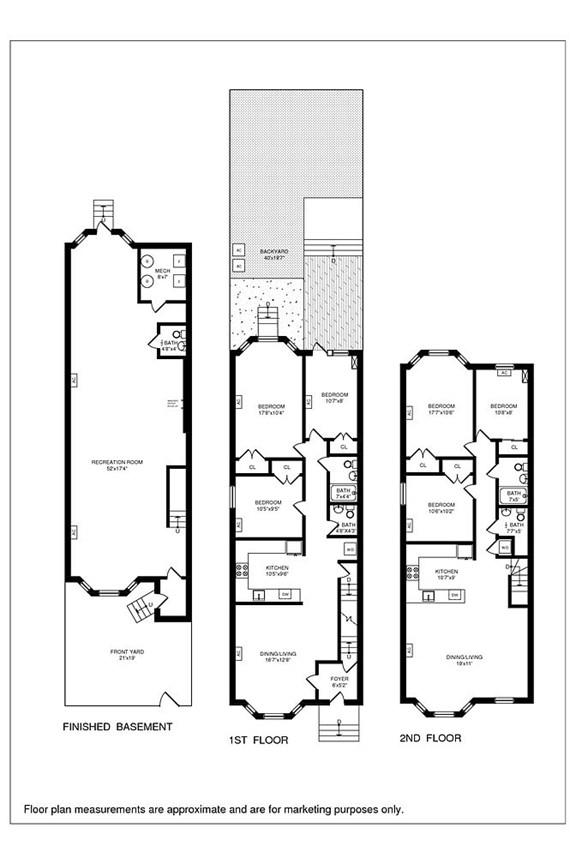

390 East 49th Street isn’t your average home. This gut-renovated, semi-detached 2-family townhouse is a perfect opportunity to live in a generously appointed 2, 900 sq ft townhouse and enjoy monthly rental income or add it to your investment rental property portfolio.

The owner’s duplex is a 3-bed, 2. 5-bath masterpiece, strategically designed so the owner retains exclusive access to the recreation room in the cellar and the backyard. Each bedroom is sized to perfection and features great closets and a washer/dryer combo. The kitchen is chef-worthy with premium appliances, which are beautifully designed and efficient, and paired with exquisite cabinetry and tile work. The Brazilian oak flooring guides you through the space with easily allocated living and dining.

The second-floor rental is a 3-bed, 1. 5-bath with a logical floor plan and equally exquisite finishes. Perfectly sized bedrooms are complemented by oversized windows, a skylight, sun-filled common spaces, and the overwhelming potential to be at peace. Each unit is being rented at 1st Fl- $3, 024(FEPS) and 2nd Fl -$2, 610. 00 (cash). The basement is currently vacant. Annual taxes are approximately $8, 442.

390 East 39th Street is centrally located in the rapidly emerging neighborhood of East Flatbush, just south of Crown Heights with easy access to reliable train lines, the 2, 3, 4, and 5, and plenty of buses, that will take you Downtown Brooklyn and into Manhattan in minutes. Chic shops, art galleries and notable restaurants and bars, are your neighbors—ensuring you don’t have to travel far for amazing entertainment and amenities. Prospect Park, Kings Theater, Kings Plaza Mall, and the Marine Park Yacht Club are also short rides away for your enjoyment. If you’ve been searching for the perfect home, search no more. Welcome Home.

Features

- Town: Brooklyn

- Year Built: 2019

- Cooling: Central

- Building Access : Walk-up

- Service Level: Video Intercom

- Built Size: 20'x54'

- OLR#: 0096181

- Days on Market: 233 days

- Website: https://www.raveis.com

/prop/0096181/390east49thstreet_brooklyn_ny?source=qrflyer

All information is intended only for the Registrant’s personal, non-commercial use. This information is not verified for authenticity or accuracy and is not guaranteed and may not reflect all real estate activity in the market. RLS Data display by William Raveis Real Estate, Inc.

All information is intended only for the Registrant’s personal, non-commercial use. This information is not verified for authenticity or accuracy and is not guaranteed and may not reflect all real estate activity in the market. RLS Data display by William Raveis Real Estate, Inc.Listing courtesy of Keller Williams Realty Empire

William Raveis Family of Services

Our family of companies partner in delivering quality services in a one-stop-shopping environment. Together, we integrate the most comprehensive real estate, mortgage and insurance services available to fulfill your specific real estate needs.

Customer Service

888.699.8876

Contact@raveis.com

Our family of companies offer our clients a new level of full-service real estate. We shall:

- Market your home to realize a quick sale at the best possible price

- Place up to 20+ photos of your home on our website, raveis.com, which receives over 1 billion hits per year

- Provide frequent communication and tracking reports showing the Internet views your home received on raveis.com

- Showcase your home on raveis.com with a larger and more prominent format

- Give you the full resources and strength of William Raveis Real Estate, Mortgage & Insurance and our cutting-edge technology

To learn more about our credentials, visit raveis.com today.

Sarah DeFlorioVP, Mortgage Banker, William Raveis Mortgage, LLC

NMLS Mortgage Loan Originator ID 1880936

347.223.0992

Sarah.DeFlorio@Raveis.com

Our Executive Mortgage Banker:

- Is available to meet with you in our office, your home or office, evenings or weekends

- Offers you pre-approval in minutes!

- Provides a guaranteed closing date that meets your needs

- Has access to hundreds of loan programs, all at competitive rates

- Is in constant contact with a full processing, underwriting, and closing staff to ensure an efficient transaction

Robert ReadeRegional SVP Insurance Sales, William Raveis Insurance

860.690.5052

Robert.Reade@raveis.com

Our Insurance Division:

- Will Provide a home insurance quote within 24 hours

- Offers full-service coverage such as Homeowner's, Auto, Life, Renter's, Flood and Valuable Items

- Partners with major insurance companies including Chubb, Kemper Unitrin, The Hartford, Progressive,

Encompass, Travelers, Fireman's Fund, Middleoak Mutual, One Beacon and American Reliable

390 East 49th Street, Brooklyn (East Flatbush), NY, 11203

$1,120,000

Customer Service

William Raveis Real Estate

Phone: 888.699.8876

Contact@raveis.com

Sarah DeFlorio

VP, Mortgage Banker

William Raveis Mortgage, LLC

Phone: 347.223.0992

Sarah.DeFlorio@Raveis.com

NMLS Mortgage Loan Originator ID 1880936

|

5/6 (30 Yr) Adjustable Rate Jumbo* |

30 Year Fixed-Rate Jumbo |

15 Year Fixed-Rate Jumbo |

|

|---|---|---|---|

| Loan Amount | $896,000 | $896,000 | $896,000 |

| Term | 360 months | 360 months | 180 months |

| Initial Interest Rate** | 5.375% | 6.250% | 5.750% |

| Interest Rate based on Index + Margin | 8.125% | ||

| Annual Percentage Rate | 6.550% | 6.346% | 5.907% |

| Monthly Tax Payment | N/A | N/A | N/A |

| H/O Insurance Payment | $125 | $125 | $125 |

| Initial Principal & Interest Pmt | $5,017 | $5,517 | $7,440 |

| Total Monthly Payment | $5,142 | $5,642 | $7,565 |

* The Initial Interest Rate and Initial Principal & Interest Payment are fixed for the first and adjust every six months thereafter for the remainder of the loan term. The Interest Rate and annual percentage rate may increase after consummation. The Index for this product is the SOFR. The margin for this adjustable rate mortgage may vary with your unique credit history, and terms of your loan.

** Mortgage Rates are subject to change, loan amount and product restrictions and may not be available for your specific transaction at commitment or closing. Rates, and the margin for adjustable rate mortgages [if applicable], are subject to change without prior notice.

The rates and Annual Percentage Rate (APR) cited above may be only samples for the purpose of calculating payments and are based upon the following assumptions: minimum credit score of 740, 20% down payment (e.g. $20,000 down on a $100,000 purchase price), $1,950 in finance charges, and 30 days prepaid interest, 1 point, 30 day rate lock. The rates and APR will vary depending upon your unique credit history and the terms of your loan, e.g. the actual down payment percentages, points and fees for your transaction. Property taxes and homeowner's insurance are estimates and subject to change.